Fintech

Redefining Finance with Custom Fintech Solutions tailored for Innovation & Growth

Fintech Solutions by NMG’s Expert Developers

Our team understands the dynamic nature of the financial industry and leverages its expertise to deliver solutions that are not only efficient but also secure and scalable. This adaptability ensures that financial institutions can overcome contemporary challenges and evolve with the changing demands of the global market. Our custom fintech software development services enable clients to realize tailored fintech solutions or enhance their existing systems, ensuring compliance with legal standards.

Furthermore, NMG Technologies places a significant emphasis on user experience. Thus, our products are designed to simplify complex financial operations, making them accessible to a broader audience, including those with minimal financial literacy. This user-centric approach fosters greater customer satisfaction and loyalty, which is vital in the competitive fintech landscape.

NMG Technologies has cemented its position as a frontrunner in the financial technology sector by offering unparalleled FinTech solutions such as investment platforms, insurance marketplaces, and financial monitoring apps.

As a leading fintech app development company, our approach to fintech is rooted in innovation, customization, and seamless integration based on cutting-edge technologies like blockchain, AI, and data analytics, thereby distinguishing us from our competitors.

What is Fintech?

Fintech, short for “financial technology,” is the innovative use of technology to improve and automate financial services. It covers various aspects, including personal banking, online payments, digital wallets, wealth management, crowdfunding, and even cryptocurrency. By harnessing the power of the internet, mobile devices, software technology, and cloud services, FinTech companies strive to make financial services more accessible, faster, and less costly than traditional financial methods.

Moreover, Fintech aims to democratize access to financial services, offering tools for savings, investment, and online payments to populations previously underserved by the traditional banking system. Over the past decade, this sector has experienced remarkable growth in fostering a more inclusive ecosystem, empowering individuals and businesses to manage their finances with greater independence. Additionally, fintech contributes to a more secure and transparent financial ecosystem by leveraging advanced technologies like blockchain to enhance security and protect against fraud, ensuring the integrity of financial transactions.

Types of FinTech Solutions

Fintech Software Development Services that NMG Tech offers

Our solutions transform how we manage, invest, and interact with finances, making it more inclusive and efficient. Our fintech application development services provide comprehensive support through the entire Software Development Life Cycle (SDLC), including consultation, team assembly, and ongoing support.

Investment & Banking Apps

- Secure Payment Gateway: Our apps ensure secure data transmission and adhere to relevant financial regulations.

- Payment Processing: Secure integration with a payment gateway facilitates deducting the purchase amount from the user’s bank account.

- Interest Withdrawal: Users can withdraw their earned interest on the bonds at any time.

- Bond Purchase: Users can securely purchase bonds after agreeing to terms and selecting the desired quantity. Fintech app

development is crucial for creating secure and scalable investment and banking apps.

Group Management App

- Fund Group Management: Coordinators can create, view, and manage fund groups conveniently from the app, eliminating the need for calls. It involves secure user accounts with different access levels (coordinator vs. member) and functionalities for managing group details, member lists, and potentially fund transactions.

- Fund Coordination: The app facilitates coordinating financial contributions among group members.

Chat Functionality: An integrated chat system allows group members to communicate directly within the app. - Payment Reminders: Push notifications remind members about upcoming due dates to ensure timely contributions.

Knowledge Hub

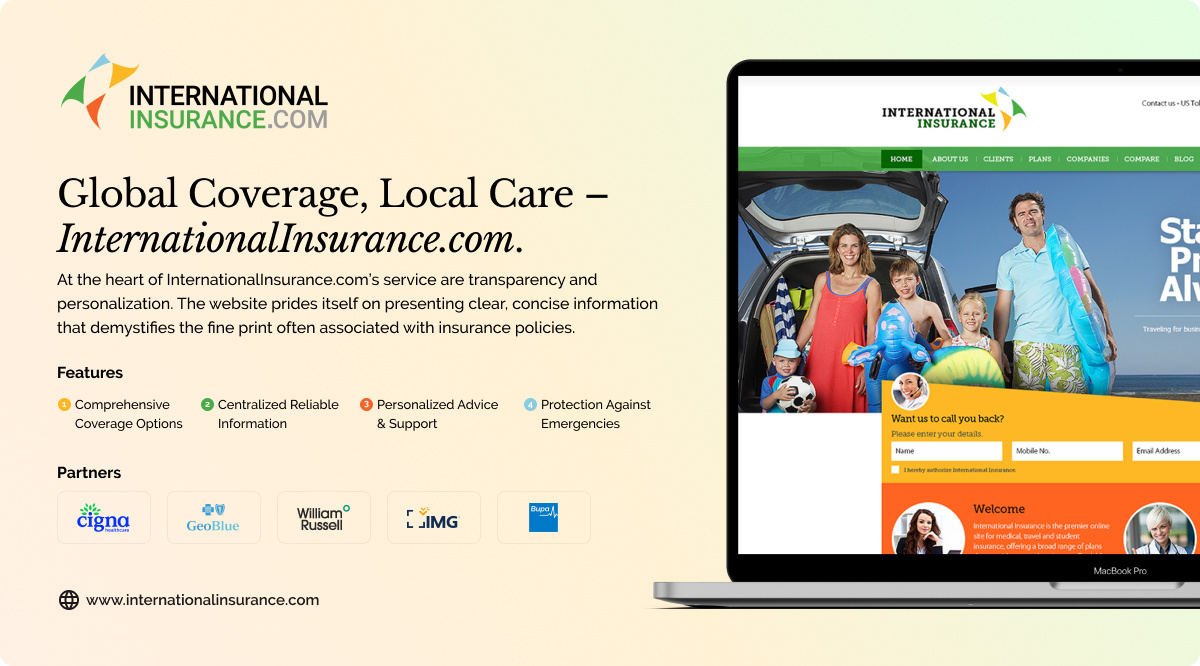

- Educational Content: Resources and blog posts aim to educate users on the value of travel and medical insurance.

- Company Directory: A comprehensive listing allows users to compare leading international insurance companies.

- Free Quotes: Users can obtain free quotes and detailed plan information by filling out a form.

- Customer Support: A contact channel is available for users to clarify doubts or ask questions.

CASE STUDY

Unique Features of Our FinTech Solutions

- Investment Planning Calculator

- Automated Investment Functionality

- Round-up Functionality

- Insurance Plan Comparison

- Premium Quote Generation Tool

-

Investment Planning Calculator

This tool helps users assess their potential portfolio value based on various factors like:

- Initial Investment amount,

- Investment duration,

- Automatic purchase settings,

- Auto-purchase frequency (weekly, bi-weekly, monthly) and

- Roundup functionality (automatically invest spare change).

It involves complex calculations considering factors like interest rates, compounding interest, and potential market fluctuations, as applicable.

-

Automated Investment Functionality

This allows users to set up automatic purchases of additional investments at specified intervals (weekly, bi-weekly, monthly). The system is linked to the user’s bank account and triggers automatic transactions based on their pre-defined preferences

.webp)

-

Round-up Functionality

.webp)

This feature automatically rounds up the spare change from user transactions and invests those rounded-up amounts. It requires integrating the user’s bank account to access transaction details and invest the difference.

.

.webp)

-

Insurance Plan Comparison

.webp)

This feature allows users to compare different insurance plans from various international providers from a database of plans with detailed information about benefits, conditions, limitations, and exclusions. The user interface allows for side-by-side comparisons and filtering based on user needs.

.webp)

-

Premium Quote Generation Tool

.webp)

This feature generates personalized insurance quotes based on user-provided information through a form. It is achieved by integrating insurance providers’ systems and algorithms to calculate premiums based on factors like age, health history, and chosen coverage.

Why is NMG the perfect choice for Fintech Solutions?

Our proven track record in delivering innovative, user-centered fintech services makes us an ideal partner for businesses that aim to leverage technology for financial success.

1. Expertise in Emerging Technologies

With in-depth expertise in blockchain, artificial intelligence (AI), and data analytics, NMG Technologies is at the forefront of incorporating emerging technologies into their fintech solutions, which can significantly enhance operational efficiency and customer satisfaction.

2. User-Centric Design

Understanding the importance of a seamless user experience, their fintech solutions are designed with the end-user in mind, simplifying complex financial operations and making them accessible to non-experts.

3. Scalability and Security

NMG Technologies prioritizes the scalability and security of its fintech solutions, offering platforms that can grow with your business while protecting sensitive financial data against emerging cyber threats.

4. Real-Time Analytics and Insights

Their solutions provide real-time data processing, which is crucial for making informed financial decisions quickly. Enhanced analytical capabilities offer deeper insights into market trends, enabling proactive financial management.

5. Regulatory Compliance

NMG Technologies is well-versed in the regulatory landscape of the financial sector. Their fintech solutions ensure compliance with the latest financial regulations, reducing the risk of legal challenges for your business.

6. Regulatory Compliance

NMG Technologies is well-versed in the regulatory landscape of the financial sector. Their fintech solutions ensure compliance with the latest financial regulations, reducing the risk of legal challenges for your business.

In conclusion, our solutions are designed to tackle modern financial challenges, enhance fraud detection, streamline real-time data processing, and provide personalized financial insights. With us, financial institutions can confidently adapt to an evolving market and set new benchmarks for success.

Your Journey, Our Expertise:

Results-Driven Successful Partnerships

CEO and Founder, Atlys Inc

Head of Marketing

Sai Karan Vedulla

London & Partners,

VP & Chief Representative

Steve Delvecchia

VP Digital Engagement,

Resources Connection Inc.

(NASDAQ Listed)

Related Case Studies

Compound banc

Mobile Application

International Insurance

Website Design

Wealth Concert

Web Application

Frequently Asked Questions

What are Fintech Solutions?

Fintech, short for Financial Technology, refers to innovative technologies designed to improve and automate the delivery and use of financial services. These solutions encompass a broad range of financial activities, including payments, investments, financing, insurance, and wealth management.

How do Fintech Solutions benefit my business?

Fintech solutions offer businesses enhanced efficiency, reduced costs, increased speed of service, and improved customer experience. They allow for streamlined processes, better financial management, and access to insights and analytics to inform decision-making.

Are Fintech Solutions secure?

Yes, Fintech solutions prioritize security, employing advanced encryption techniques, secure authentication mechanisms, and compliance with industry standards and regulations to protect against fraud and cyber threats.

Can Fintech Solutions integrate with my existing business systems?

Many Fintech solutions are designed for seamless integration with existing business systems, providing flexible APIs and customizable interfaces to fit various operational needs.

What types of payments can Fintech solutions handle?

Fintech platforms can handle a wide range of payments, including mobile payments, electronic bank transfers, cryptocurrencies, and card payments, enhancing the payment experience for both businesses and customers.

Do Fintech Solutions support international transactions?

Fintech solutions often support international transactions, allowing businesses to easily send and receive payments across borders with lower fees and real-time exchange rates compared to traditional banking services.

How can Fintech solutions aid in financial reporting and analysis?

Fintech solutions provide powerful analytics and reporting tools, enabling businesses to track financial performance in real-time, forecast future trends, and make data-driven decisions to optimize operations.

What is the best way to select a Fintech solution for my business?

Selecting the right Fintech solution involves assessing your specific business needs, budget constraints, and scalability requirements. Researching and comparing different options, reading customer reviews, and possibly consulting with a Fintech expert can help in making an informed decision.

How can Fintech solutions help in improving customer experience?

Fintech solutions improve customer experience by providing convenient, fast, and personalized financial services. Features such as mobile banking, instant payments, and automated customer support can significantly enhance customer satisfaction and loyalty.

What future trends can we expect in Fintech solutions?

The future of Fintech is promising, with trends like artificial intelligence, blockchain technology, and open banking gaining momentum. These innovations are expected to further revolutionize financial services, making them more secure, efficient, and accessible to a broader audience.